Accounts Receivable Retry

The Accounts Receivable Retry feature allows you to automatically retry payments on orders sent to Accounts Receivable on a schedule that you can define. These order can end up in Account Receivable based on a number of different setting within the account not limited to auto order payments that have been declined.

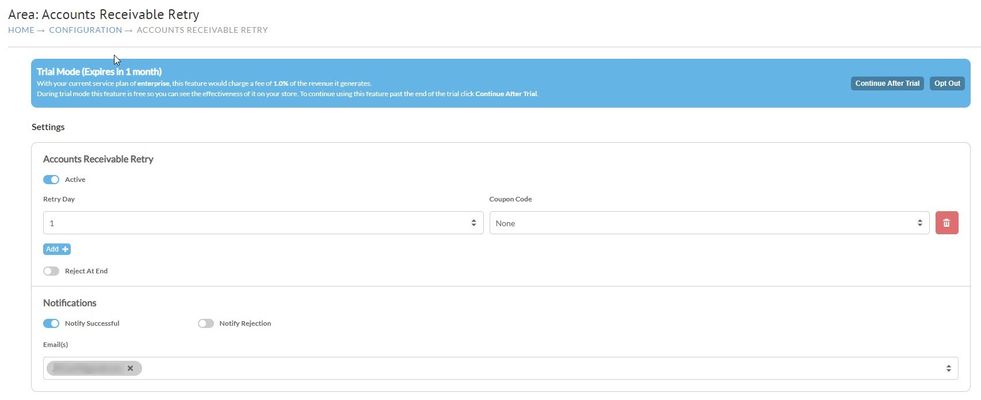

During trial mode this feature is free so you can see the effectiveness of it on your store. To continue using this feature past the end of the trial click Continue After Trial.

Settings

Main Menu → Configuration → (Back Office) Accounts Receivable Retry

| Field Name | Description |

|---|---|

| Retry Day | The day that the retry will be attempted after the order is sent into Accounts Receivable. Max number of days 7. |

| Coupon Code | Allows you to apply a coupon / discount to the order. |

| Reject at End | Will reject the order at the end of the number of retries. If not configured the order will simply stay in Accounts Receivable |

| Notify Successful | Allows the system to sent an email if a retry payment is Successful. By default this email is set to the Owner User |

| Notify Rejection | Allows the system to sent an email if the retry payment is Rejected. By default this email is set to the Owner User |

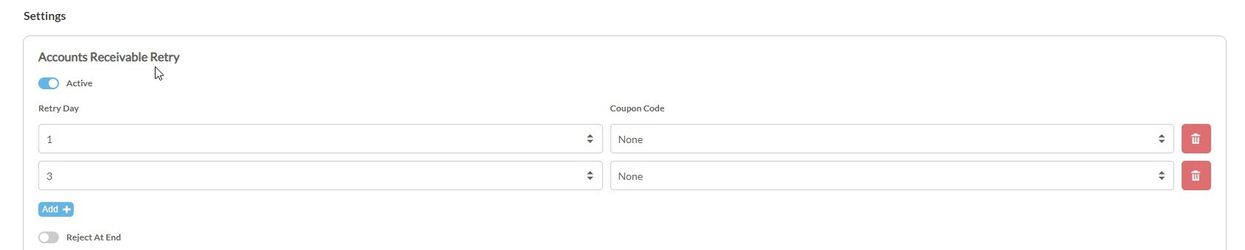

These settings allow you to set the number of retires (max. 7) and when each retry will take place. In the example above we are doing a single retry a day after the order was sent into accounts receivable. Below we will show an example with 2 retries, one on the first day and another on the third day.

Statistics

The statistics shows the total revenue, number of attempts, number of successes, and any discounts applied to orders being retried from within accounts receivable.

Helpful Links

Pricing

Pricing of this feature is based upon the currently selected service plan of your account:

- New Business - Not Available

- Small = 3% of processed payments.

- Medium - 2.5% of processed payments

- Large = 2% of processed payments.

- Enterprise = 1% of processed payments.