| Table of Contents |

|---|

...

First Party API Credentials. The information for these fields is provided by PayPal when you obtain your API Credentials (API Signature).

| Name | Description |

|---|---|

| API User Name | Enter the User Name supplied by PayPal |

| API Password | Enter the API Password supplied by PayPal |

| API Signature | Enter the API Signature supplied by PayPal |

Amazon Payments

To accept Amazon Payments as a Payment Method, click the check box to the left of the "Amazon Payment" field. More fields will be revealed

...

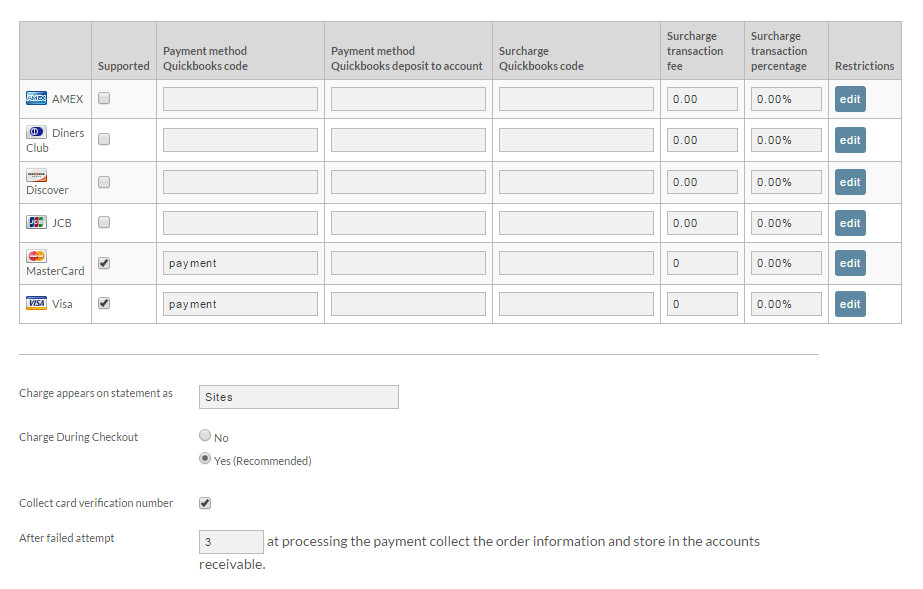

To accept Credit Cards as a Payment Method, click the checkbox to the left of the "Credit Cards" Field. More fields will be revealed to complete the configuration.

UltraCart currently supports the Six major types of credit cards: Visa, MasterCard, American Express, Discover, Diners Club, and JCB. For each supported card, check the checkbox to the right of the card name. Only check those that your transaction gateway supports.

| Name | Description | ||

|---|---|---|---|

| Charge appears on statement as | Enter the name of the company that will appear on the customer's credit card statement. To alleviate confusion to the customer, the billed by name will be printed on their receipt. This will help customers associate the charge on their credit card with the online store if the company name and DBA are different. This also helps prevent them from initiating a charge back. | ||

| Charge During Checkout | This option tells the system if the customer will be charge in real time when the order is placed or after. It is always recommended to keep this setting to yes unless you are setup to charge the customer after shipment. | ||

| Collect Card Verification Value number | When this box is checked, the customer MUST enter the Card Verification Value (CVV2) number that appears on the back of their credit card. Note: Discover Card calls it the "Cardmember ID". This is performed only momentarily for real-time charge during checkout. This data is NOT retained in the database!

| ||

| After Failed Attempts | This setting will tell the system how many time the customer card can fail before the order is collect and sent to Accounts Receivable. If set to Blank then the customers card can fail over and over again until the customer corrects the issue. |

Affirm

To accept Affirm as a Payment Method, click the checkbox to the left of the "Affirm" Field. More fields will be revealed to complete the configuration.

...

To accept Cash as a Payment Method, click the checkbox to the left of the "Cash" Field.

| Info |

|---|

Cash orders are placed through the Back End Order Entry application (launch from the order management menu). |

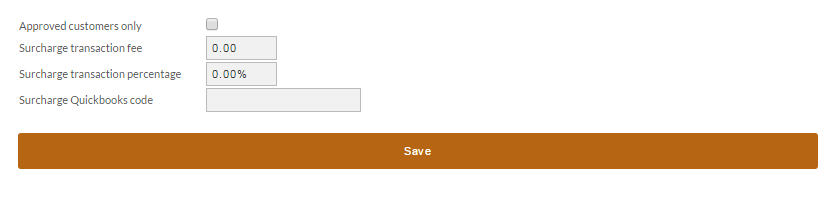

COD (cash on delivery)

To accept COD (cash on delivery) as a Payment Method, click the checkbox to the left of the "COD" Field. More fields will be revealed to complete the configuration.

| Name | Description |

|---|---|

| Approved customers only | Check this box if you want to accept COD orders for your "pre-approved customers only". You must enable customer profiles for this functionality. |

| Surcharge Transaction Fee | This is a merchant's opportunity to pass along the cost of C.O.D. fees to the customer. Enter the amount in dollars and cents. |

| Surcharge Transaction Percentage | This percentage is in addition to the surcharge transaction fee. Enter the percentage in decimal. |

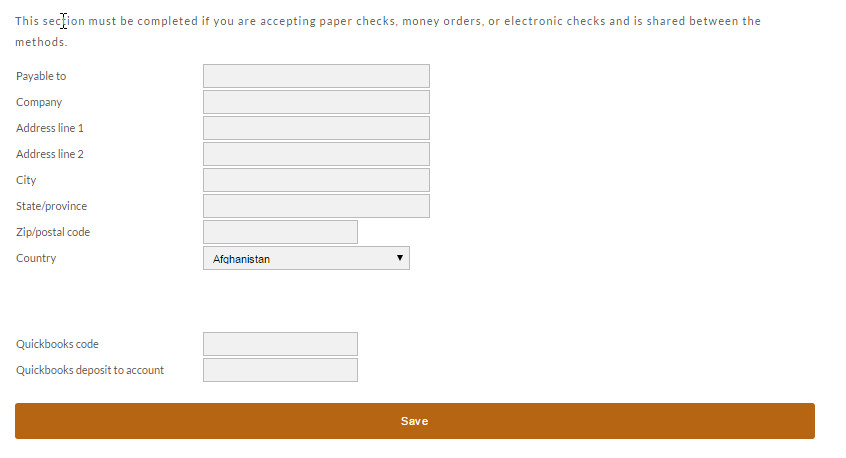

Paper Checks - Money Orders - Electronic Checks

Paper checks, Electronic checks and Money Orders all follow the same configuration, simply click the box to the left of the desired payment option to display the configuration for each.

| Name | Description |

|---|---|

| Payable to | If the checks or money orders need to be made payable to a company name that differs from the one selling the items, it should be entered here. |

| Company | Enter the Company selling the product here. |

| Address line 1 | Specify the location where customers mail the checks or money orders. Some large merchants use a cash management and lockbox service provided by their corporate bank and will specify a post office box where the mailings should go. |

| Address line 2 | This field is to be used when the address is two lines in length (P.O. Box, etc.). |

| Fields 5-8 | Enter the City, State/province, Zip/postal code, and Country. |

The following is an example of what will appear at the bottom of an order that is held in Accounts Receivable for approval.

...

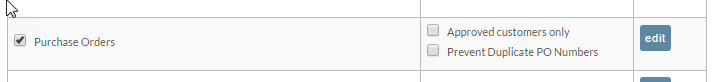

To accept Purchase Orders as a Payment Method, click the checkbox to the left of the "Purchase Order" Field. More fields will be revealed to the right.

| Name | Description | ||

|---|---|---|---|

| Approved customers only | Check this box to restrict purchase orders for approved customers only. Most merchants that approve purchase orders will make them available for "approved customers only".

| ||

| Prevent Duplicate PO Numbers | This option will do just want it say, it will keep a customer from using a PO Number that has already been used on another order. |

Quote Request

To accept Quote Request as a Payment Method, click the checkbox to the left of the "Purchase Order" Field. More fields will be revealed to the right.

| Name | Description | ||

|---|---|---|---|

| Approved customers only | Check this box to restrict purchase orders for approved customers only. Most merchants that approve purchase orders will make them available for "approved customers only".

|

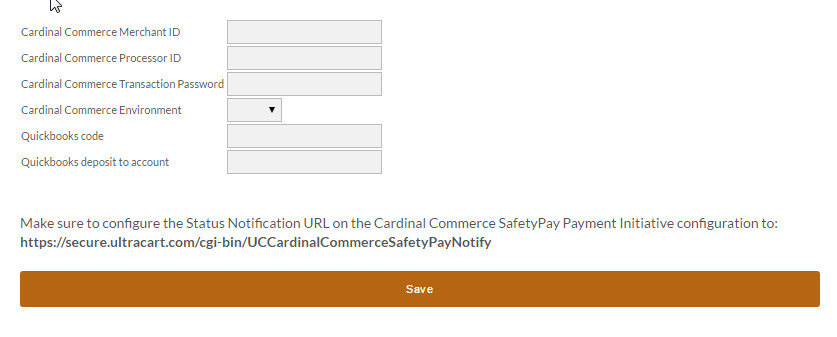

Saf-T-Pay

SAF-T-PAY is a secure payment system that allows non-credit card usersand overseas shoppers to make online purchases directly through theirlocal bank. To learn more about and register with this integrated feature go to: http://www.saftpay.com.

Accept Saf-T-Pay: Check this box if you want to configure Saf-T-Pay. This section will then expand to reveal the configuration area. Enter your Merchant ID, User ID and Password that were assigned to you when you registered with Saf-T-Pay.

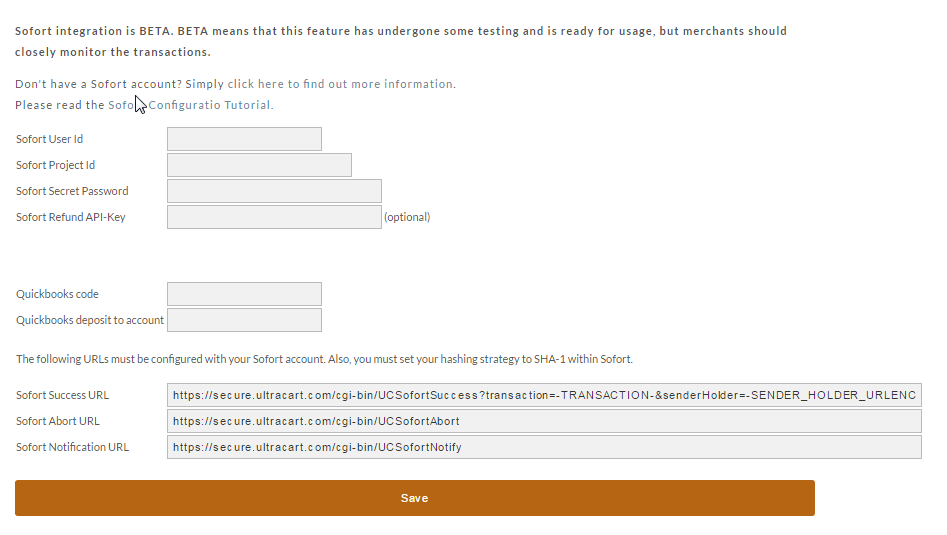

Sofort

To accept Sofort as a Payment Method, click the checkbox to the left of the "Sofort" Field. More fields will be revealed to complete the configuration.

To complete the configuration simply provide the Sofor User ID, Project ID, and Secret Password.

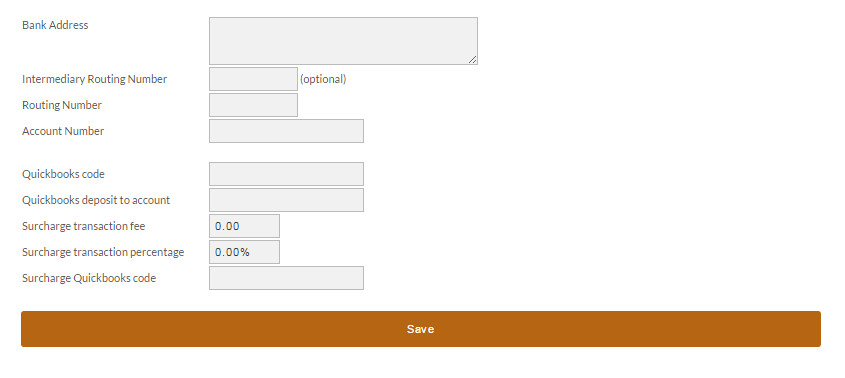

Wire Transfer

To accept Wire Transfer as a Payment Method, click the checkbox to the left of the "Wire Transfer" Field. More fields will be revealed to complete the configuration.

| Info |

|---|

Wire transfers apply to U.S. based merchants ONLY! Your bank information will be printed on the Customer's receipt after checkout. The customer will then have to work directly with their banking institute to perform the Wire Transfer using the information you provide on this section. |

Field #1: Surcharge transaction fee: This is a merchant's opportunity to pass along the cost of Wire Transfer fees to the customer. Enter the amount in dollars and cents.

Field #2: Surcharge transaction percentage: This percentage is in addition to the surcharge transaction fee. Enter the percentage in decimal. Example "1.5".

Field #3: Bank Address: A text box is provided for you to enter the entire Bank Address. Press the "Enter" key at the end of each line.

Field #4 & 5: Account Number & Routing Number: Most businesses have more than one bank account. In the boxes provided, enter the Routing Number and Account Number for the appropriate account you want the wire transfer made to.

| Name | Description |

|---|---|

| Bank Address | A text box is provided for you to enter the entire Bank Address. Press the "Enter" key at the end of each line. |

| Routing Number | Most businesses have more than one bank account. In the boxes provided, enter the Routing Number |

| Account Number | Most businesses have more than one bank account. In the boxes provided, enter the Account Number for the appropriate account you want the wire transfer made to. |

| Surcharge transaction fee | This is a merchant's opportunity to pass along the cost of Wire Transfer fees to the customer. Enter the amount in dollars and cents. |

| Surcharge transaction percentage | This percentage is in addition to the surcharge transaction fee. Enter the percentage in decimal. Example "1.5". |