...

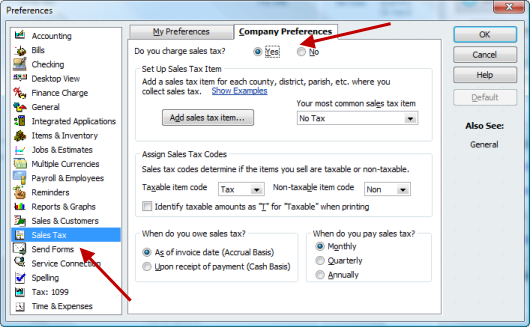

- Go to the Edit menu and click Preferences

- In the Preferences window, click Sales Tax in the list on the left.

- Click the Company Preferences tab.

- For the question "Do You Charge Sales Tax?" select "Yes".

There are several other settings that you will need to make decisions on.

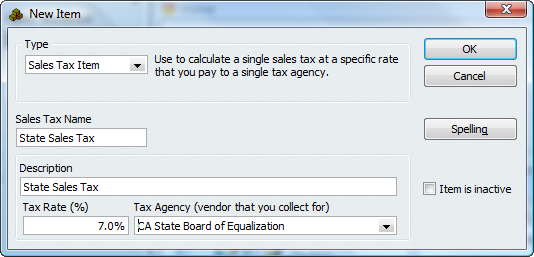

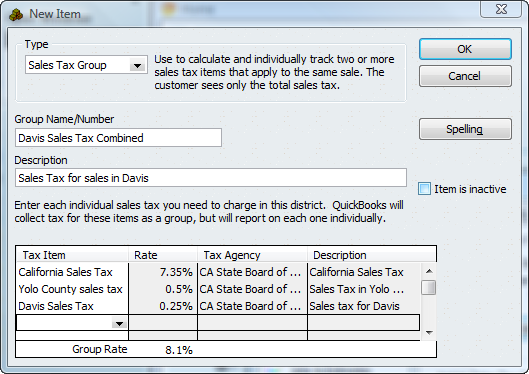

QuickBooks will insist that you set up a most common sales tax item. This will usually be your state sales tax. However, it may be multiple jurisdictions such as state, county, and city tax. These will need to be created before QuickBooks will accept Sales Tax.

You may need to get expert advice for your company tax settings.

Sales Tax Codes

Depending on your state and local sales tax requirements, the preset taxable (TAX) and non-taxable (NON) sales tax codes you see may be the only ones you'll need. If your tax agency requires you to specify additional sales tax codes to track taxable and non-taxable sales, such as for non-taxable out of state sales, refer to QuickBooks™ Help for more information on how to set up additional sales tax codes and for some examples of commonly-used non-taxable sales tax codes.

...